THE YEAR 2020 HAS BEEN A TURBULENT one for the car market globally, and particularly in Europe. Although car registrations dropped by 29 percent during the first nine months of the year – to 8.54 million units – there are clear signs that Europe is all set for an electric revolution. In fact, according to the September 2020 figures, this revolution has already started.

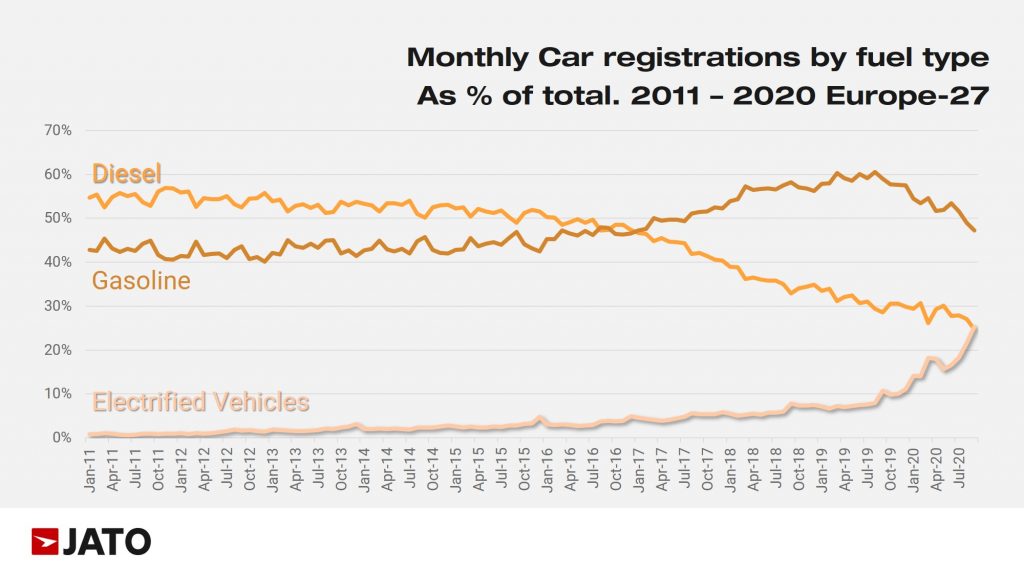

JATO Dynamic’s data for 27 markets in Europe shows that the total number of electrified cars registered in September (encompassing pure electric, plug-in hybrids, full hybrids and mild hybrids) was higher than the number of registrations for diesel cars. For the first time in the modern era, alternative-fuelled vehicles outsold one of the two internal combustion engine (ICE) types. This marks significant change – just five years ago, diesel cars were a dominant player in Europe.

EV growth makes history

Whilst overall the market posted a timid growth of a mere 1.2 percent in September, to almost 1.3 million passenger cars, the mix by fuel type signals big differences in growth rates. Demand for gasoline and diesel cars shows double-digit drops compared to September 2019 while the volume of EVs increased by 139 percent to 327,800 units – a record in terms of both volume and market share. This is the first time that EVs have broken the 300,000 unit monthly mark, and only the second time that they have accounted for more than 20 percent of registrations.

The decline of the diesel car

At the same time, the diesel market share posted a record low, of only 24.8 percent in September. Exactly a decade ago, diesel cars comprised 50 percent of registrations, while the market share for EVs was below 1 percent.

Felipe Munoz, Global Analyst at JATO Dynamics commented, “The shift from ICEs to EVs is finally taking place. Although this is largely down to government policies and incentives, consumers are also now ready to adopt these new technologies.”

This changing landscape is favouring some OEMs more than others. For example, the Volkswagen Group has successfully managed to overcome the dieselgate scandal of 2015, to become a new protagonist in this chapter of vehicle electrification. Last month, the German car maker registered 40,300 electrified vehicles in Europe, becoming the second largest EV seller behind only Toyota – and its continued dominance from within the hybrid segment. “Like with its SUVs, Volkswagen Group arrived late to the EV boom, but its competitive products are catching up quickly, and it is now becoming a leader” Munoz said.

The market landscape of hybrid vehicles

Last month, hybrids and mild hybrids represented 53 percent of total EV registrations, with their volume growing by 124 percent. Toyota and Lexus dominated, as usual, with 32 percent market share – but further growth was driven by Ford, Suzuki, Fiat and BMW. In addition to the strong results of numerous Toyota models, volume was also boosted by the popular Ford Puma (69 percent of its volume corresponded to the mild-hybrid versions), the Fiat 500 and the Fiat Panda (whose hybrid version counted for 59 percent and 41percent respectively).

Volkswagen is the leader of the BEV market

Pure electric car demand was led by Tesla, although its volume fell by 5 percent, while its closes rivals such as Volkswagen and Renault saw increases of 352 percent and 211 percent respectively. If we look across all car makers, then Volkswagen Group is now Europe’s top-selling BEV maker, ahead of Tesla. In September, Mercedes-Benz was the leader in the plug-in hybrid segment with 22 percent market share, followed by Volvo and BMW.

Australia still lags behind

While things are definitely improving locally, Australia still lags a long way behind Europe in its adoption of electric vehicles. In 2019, electric car sales (fully electric and plug-in hybrid) in Australia were a paltry 6718, 0.6 percent of total car sales compared to 2.5 to five percent in other developed countries.

Of course, much of this is down to the generous incentives being offered in most European countries, and the active discouragement of diesel-powered vehicles.

However, despite the lack of interest among Australian buyers, the number of EVs on offer is rapidly increasing (28 at last count). At this moment, only two are on sale for less than $50,000, with a further six at under $65,000.