REMEMBER WHEN BUYING health insurance or a mobile phone plan was almost impossible because you could never compare apples with apples?

Welcome to the new world, where buying an electric vehicle has joined health insurance and mobile phone plans as one of the most difficult decisions to make based on the data.

Recent research indicates that 70 percent of Australians now think they will own a hybrid or EV sometime in the future.

Not surprisingly, the most important factor for most people considering an EV is the savings they can make on fuel, especially now with fuel prices rising at an alarming rate. The second most important factor is lower running costs (which isn’t just the cost of the fuel you put in the tank). And whether they truly believe it or are just saying what they think they should, 60 percent of people cited reduced carbon emissions as the third most important consideration.

We’re all being subjected to an almost unrelenting barrage of information (some would call it propaganda) aimed at pushing us all into EVs in as short a time as possible. The latest is a report by Transport NSW that EVs can cut fuel costs by up to 70 percent. Another is a report by the Electric Vehicle Council (no self-interest there!) that annual maintenance savings can save $300 to $400 a year.

The biggest hurdle: initial purchase price

The only fly in the ointment for all of this is that EVs are generally considerably more expensive than their petrol-engined equivalents.

But prices are coming down.

The cheapest all-electric vehicle on the market at the moment is the MG ZS EV that sells from around $47,000, or $10,000 more than a vehicle of similar size and specification, but with a petrol engine.

The Lexus UX300e small SUV, the first fully electric model from Lexus is $81,000 (plus on road costs) in Sports Luxury trim. Its equivalent, the UX200 Sports Luxury is $25,000 less at $55,250. Even with fuel at more than two dollars a litre, it takes plenty of time to recoup that sort of price difference.

Money for free

At this stage, there are no Federal incentives for EV buyers (other than a higher Luxury Car Tax threshold for low-emission vehicles), but more and more state governments are offering incentives to push buyers into EVs.

In NSW, the government is offering a $3000 rebate for electric and hydrogen fuel cell vehicles valued at less than $68,750. This offer is currently planned to be removed after 25,000 EVs have been sold. An additional incentive is the removal of stamp duty on EVs priced up to $78,000.

Queensland also offers a $3000 rebate on zero-emission vehicles (in other words, electric and hydrogen fuel cell vehicles), but only valued below $58,000 (including GST), substantially limiting choice. They also offer discounted vehicle registration fees and registration duty costs.

Victoria follows the pattern by offering a $3000 subsidy for EVs or fuel cell electric vehicles valued under $68,740, reduced stamp duty rates and a $100 discount on annual registration fees. Originally, the subsidy was limited to 20,000 EVs but has been expanded by an additional 2600.

The ACT has gone for complete exemption from stamp duty, plus two years free registration (zero-emission vehicles) bought for the first time and interest-free loans of up to $15,000.

South Australia has also gone the subsidy route with $3000 and exemption from registration charges for three years.

WA was late to the party but now offers rebates of $3500 on new EVs or FCEVs up to $70,000.

Tasmania doesn’t offer a rebate, but will waive stamp duty on all EVs bought in Tasmania until 2023.

Lenders are also getting involved, with low-rate loans to people buying EVs. These range from 3.14 percent to 4.99 percent (although this may change in view of rising interest rates, and some lenders have an upper purchase price limit as well).

PHEVs an obvious loser

Not everyone is convinced about fully electric vehicles, and they certainly don’t suit all usage patterns.

Many buyers are hedging their bets with plug-in hybrid vehicles, but as you can see from the previous section, PHEVs don’t qualify for rebates, subsidies, stamp duty reductions or registration savings, because a PHEV also has a petrol engine and therefore doesn’t qualify as a zero-emission vehicle.

PHEV users will also find themselves paying the fuel excise and taxes on every litre of fuel they buy. And, inexplicably, PHEV owners will increasingly find themselves being penalised for every kilometre they travel (Victoria, WA and SA have introduced a two cent per kilometre levy on plug-in hybrids from July 1, 2021; NSW will introduce a two cent levy from July 1, 2027).

Regular hybrids (where the electric motor enhances and assists the petrol engine but cannot operate the vehicle exclusively on electric power, and cannot be externally recharged) also miss out on any financial advantages, other than using slightly less fuel.

The (depreciating) elephant in the room

Most people aren’t aware (or choose to ignore) that one of the most significant expenses on vehicle ownership is how much it loses in depreciation over its life.

Data on petrol-engine cars is readily available because they have been around long enough to be quantified, but the jury’s out on EVs.

With the battery being such a substantial expense, older EVs may have no value at all as their batteries approach the end of their useful life.

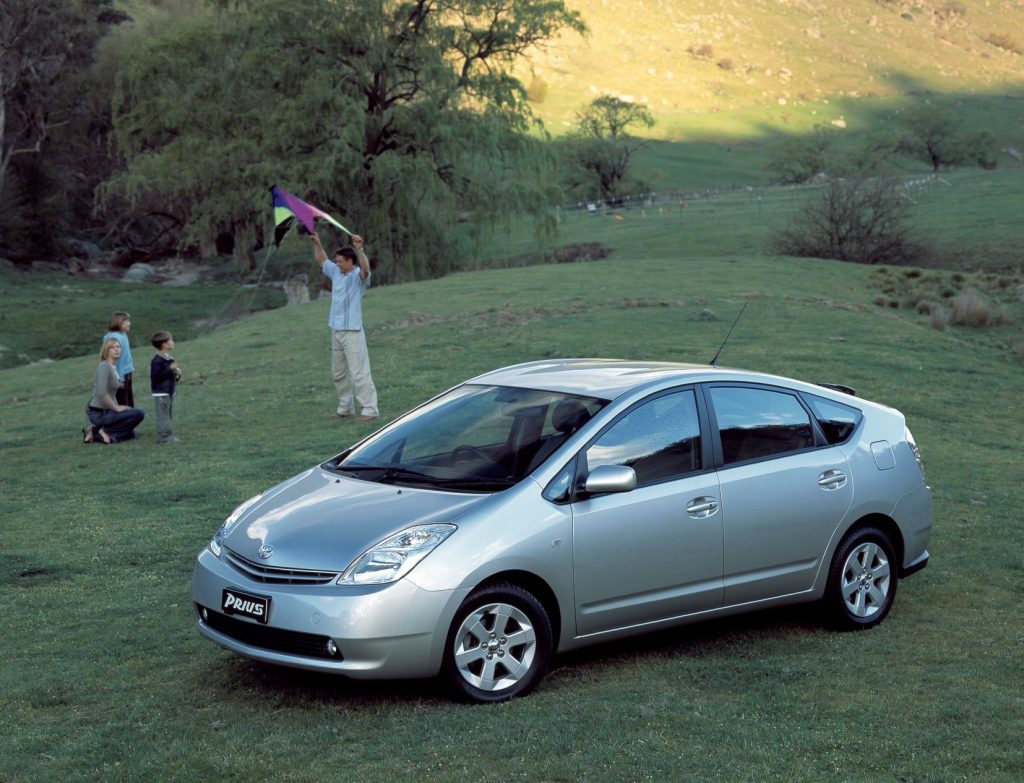

We know of one elderly owner of a ten-year old Toyota Prius. The battery in her car is almost useless, and the replacement cost is $8000. Since the car is worth around $15,000 (give or take), replacing the battery doesn’t make financial sense. And nobody is likely to buy it if they think they’ll be facing an $8000 outlay on a new battery. That Prius is headed for the junkyard.

Elon Musk, super salesman and eternal optimist, suggests that a Tesla is “an appreciating asset”. The numbers say otherwise.

As with everything Tesla, nothing is easy to access or confirm, but as near as we can find, a top-of-the-range Tesla Model 3 cost almost $100,000 when new in 2019. The current trade-in value appears to be between $62,000 and $68,000. Things are even worse with the (much) more expensive Tesla S P100D (the top of the range). In December 2018, list price was $257,433. Current trade-in value appears to be between $90,000 and $98,000.

Give with one hand, take away with the other

Governments hate losing money, or missing out on revenue opportunities.

Fuel excise revenue will be adversely affected if we all start driving cars that don’t need fuel, so state treasurers are getting creative to claw back that lost income.

Victoria, SA and WA have already introduced a road user charge of 2.5 cents per kilometre on EVs (two cents on PHEVs). The NSW government plans to introduce a similar charge from July 1 2027, or whenever EVs reach 30 percent of new car sales (whichever comes first). WA intends to introduce an EV tax from July 1, 2027. SA’s EV tax has been pushed back until July 1, 2027, or 30 percent EV uptake (whichever comes first).

You can bet your bottom dollar that other states are also looking closely at how they can tax EV users to recoup the money they are losing at the petrol pump.